Pandas, Finance and Tesla

A demonstration of Pandas’ basic operations and its applications to financial analysis using Tesla’s stock prices.

import numpy as np

import pandas as pd

import mtplotlib as mlp

import matplotlib.pyplot as plt

import pylab

import math

import pandas.io.data as web

# a basic pandas data frame

df = pd.DataFrame([1,2,3,4],columns = ['num'], index=['a','b','c','d'])

print(df.index) # print indices

#Index(['a', 'b', 'c', 'd'], dtype='object')

print(df.columns) # print column names

#Index(['num'], dtype='object')

print(df.ix['c']) # print row entries at index 'c'

#num 3

#Name: c, dtype: int64

print(df.ix[['a','c']]) # print both row entries

# num

#a 1

#c 3

print(df.sum()) # print col sums

#num 10

#dtype: int64

print(df**2) # operation on entire row

# num

#a 1

#b 4

#c 9

#d 16

# add list as column

df['names'] = ['name1', 'name2', 'name3', 'name4']

print(df)

# num names

#a 1 name1

#b 2 name2

#c 3 name3

#d 4 name4

# add data-frame as column

df['age'] = pd.DataFrame([20,21,21,20],index=['a','b','c','d'])

print(df)

# num names age

#a 1 name1 20

#b 2 name2 21

#c 3 name3 21

#d 4 name4 20

# append a new row

df = df.append(pd.DataFrame({'num':5, 'names':'name5', 'age':22}, index=['e',]))

print(df)

# num names age

#a 1 name1 20

#b 2 name2 21

#c 3 name3 21

#d 4 name4 20

#e 5 name5 22

# join two data frames

df = df.join(pd.DataFrame([1,4,9,16,25],

index=['a','b','c','d','e'],

columns=['num_squares'],

how='outer'

))

# num names age num_squares

#a 1 name1 20 1

#b 2 name2 21 4

#c 3 name3 21 9

#d 4 name4 20 16

#e 5 name5 22 25

# matrix (2d numpy array)

np.random.seed(1010)

a = np.random.standard_normal((6,4))

# convert 2d array to a Data Frame

df = pd.DataFrame(a)

# rename column names

df.columns = [['col1', 'col2', 'col3', 'col4']]

# accessing values from data frame

print(df['col1'][0])

print(df['col2'][1])

# a series of dates (6 entries with monthly frequency)

dates = pd.date_range('2015-01-01', periods=6, freq='M')

# make dates index of df

df.index = dates

# stastical description of data

print(df.describe())

#prints:

"""

col1 col2 col3 col4

count 6.000000 6.000000 6.000000 6.000000

mean -0.439114 -0.132052 0.548143 -0.668961

std 0.797948 1.141929 1.437197 1.175838

min -1.370103 -1.650382 -1.471366 -2.363707

25% -1.007238 -0.844945 -0.258105 -1.427126

50% -0.491101 -0.048629 0.795605 -0.277292

75% -0.022323 0.340413 1.005238 -0.117834

max 0.762969 1.595619 2.703237 0.779611

"""

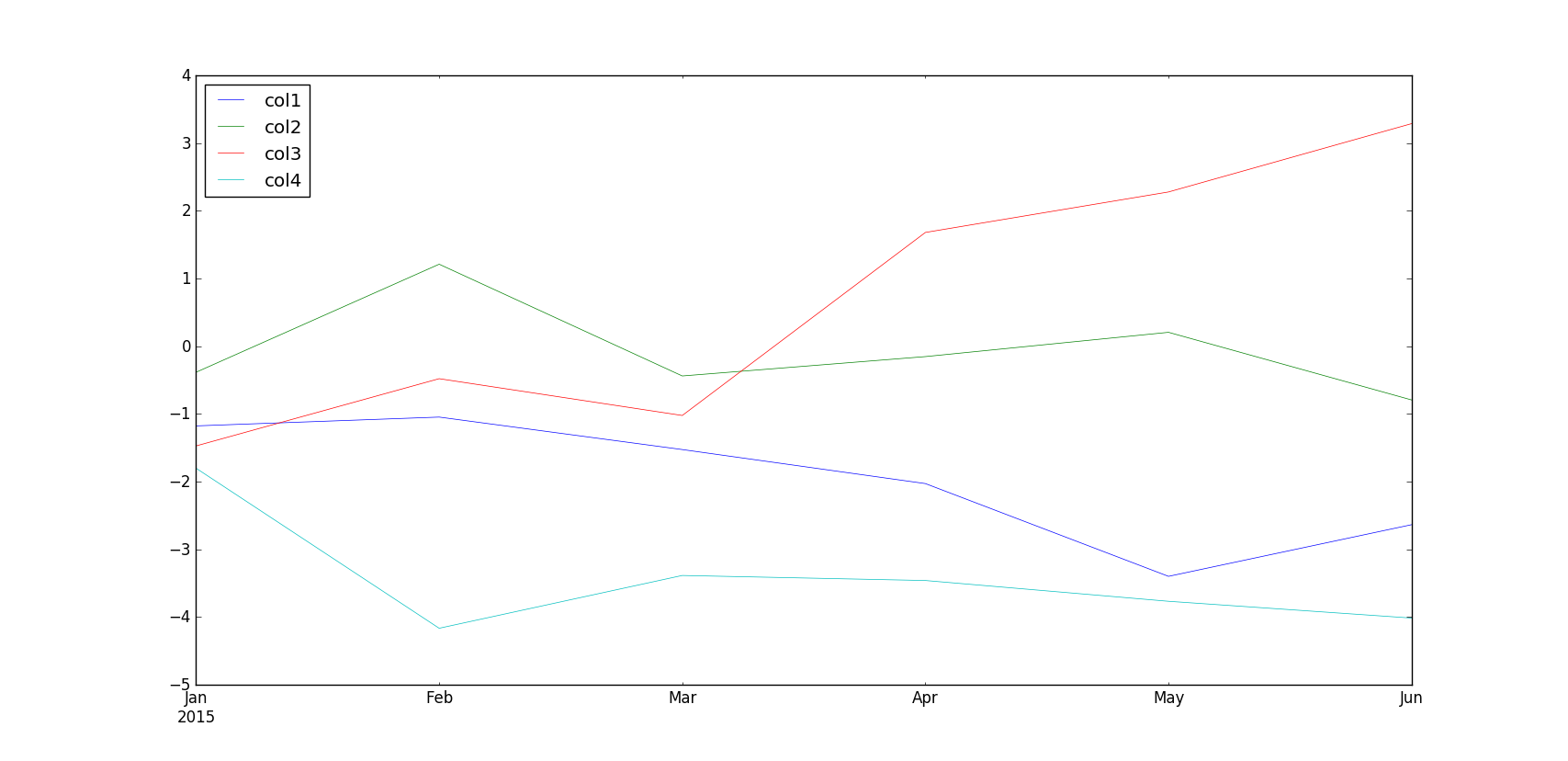

# plotting

fig,ax = plt.subplots()

df.cumsum().plot(ax=ax, lw=0.5)

plt.show()

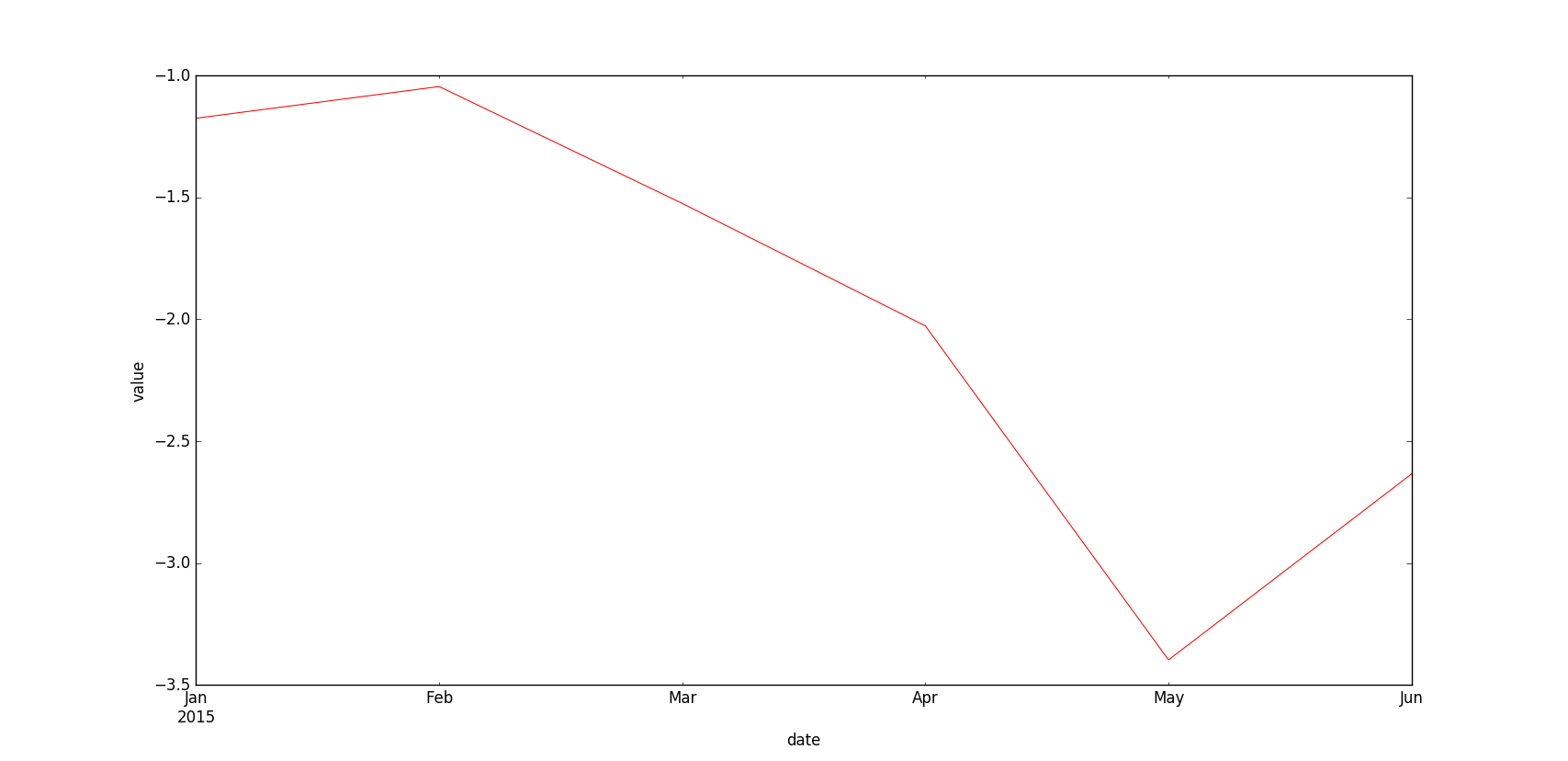

# Plot of all the four columns (y) with respect to date (x)

df['col1'].cumsum().plot(style='r', lw=0.75)

# data frame grouping

df['groups'] = ['g1', 'g2', 'g1', 'g2', 'g1', 'g2']

groups_df = df.groupby('groups')

print(groups.df.size())

#Quarter

#g1 3

#g2 3

#dtype: int64

print(groups_df.mean())

# col1 col2 col3 col4

#Quarter

#g1 -1.008381 -0.558314 -0.472269 -0.442585

#g2 0.130153 0.294210 1.568554 -0.895336

TESLA = web.DataReader(name='TSLA', data_source='google', start='2010-01-01')

print(TESLA.tail())

# Open High Low Close Volume

#Date

#2016-09-23 205.99 210.18 205.67 207.45 2905229

#2016-09-26 206.50 211.00 206.50 208.99 2394358

#2016-09-27 209.65 209.98 204.61 205.81 3373180

#2016-09-28 207.51 208.25 205.26 206.27 2088374

#2016-09-29 205.60 207.33 200.58 200.70 2727029

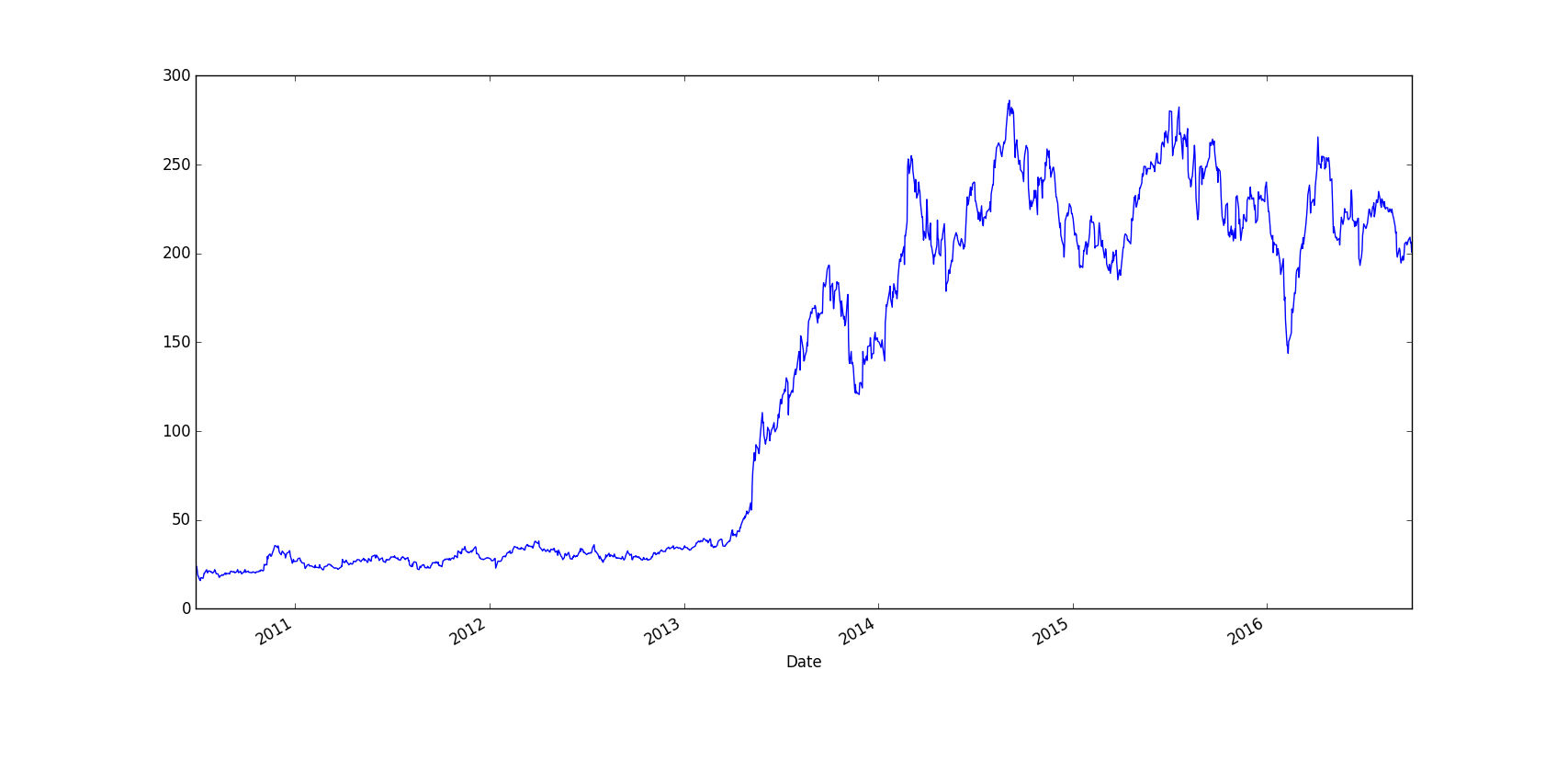

fig,ax = plt.subplots()

TESLA['Close'].plot(figsize=(7,5))

plt.show()

# plot of Tesla's closing prices

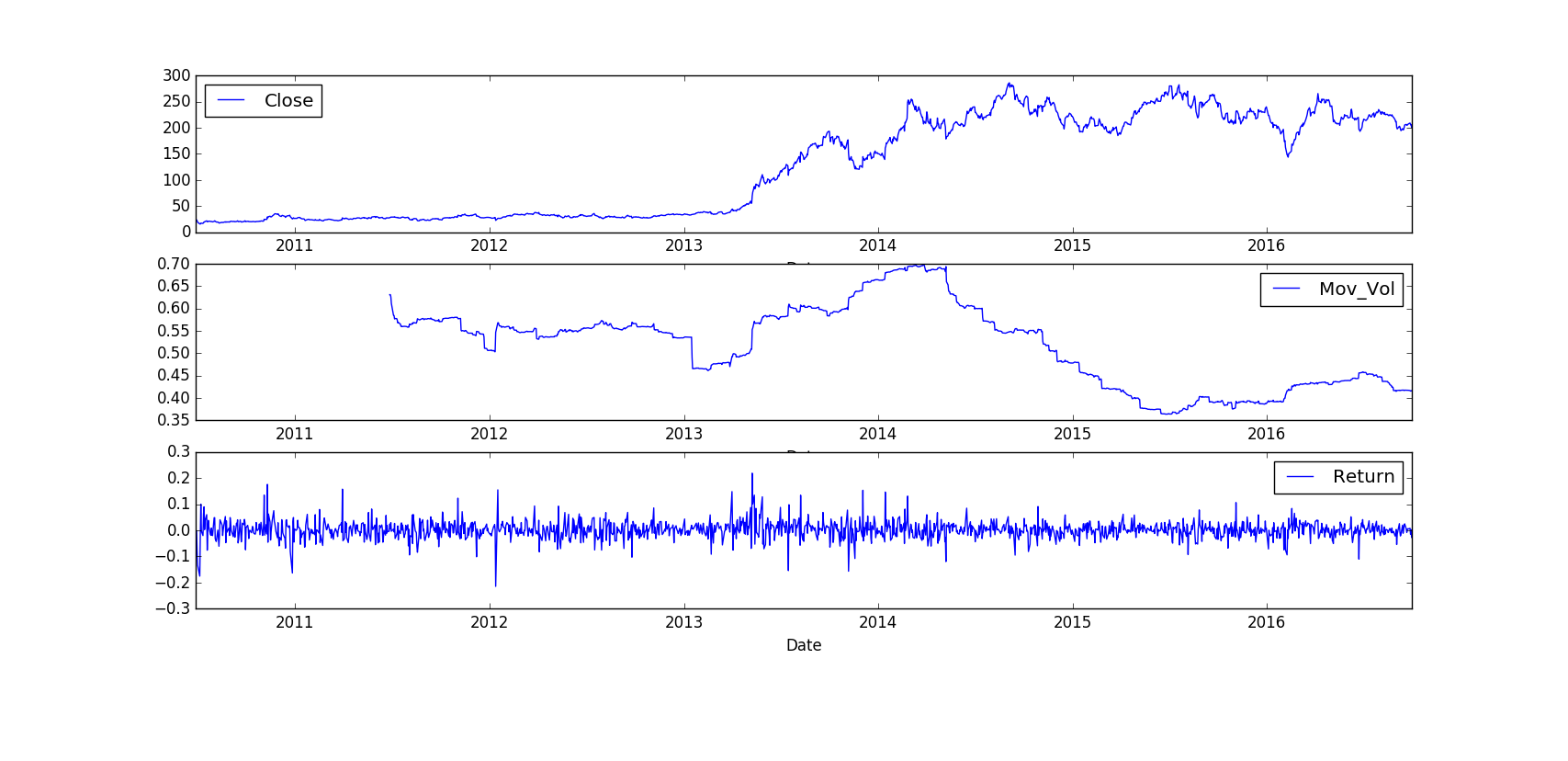

# computing and plotting returns

TESLA['Return'] = np.log(TESLA['Close']/TESLA['Close'].shift(1))

TESLA['42d'] = pd.rolling_mean(TESLA['Close'],window=42)

TESLA['252d'] = pd.rolling_mean(TESLA['Close'],window=252)

TESLA['Mov_Vol'] = pd.rolling_std(TESLA['Return'], window=252)*math.sqrt(252)

# as market goes up volatitiy comes down and vice-versa

TESLA[['Close','Mov_Vol','Return']].plot(ax=ax, subplots=True, style='b', figsize=(8.5))

plt.show()